HOW WOULD BRINGING PETROL, DIESEL UNDER GST LENS AFFECT COMMON MEN?

Jay Patel | 23 FEB 2023

Price of petrol can fall around 20% if it comes under GST !!

Currently, all of us experience brunt on high fuel prices in our daily

lives. From increasing travel expenses to high food and milk prices,

this all depends on price of petrol and diesel. India imports more

than 80% of Fuel from other countries including Russia, Iran, Saudi

Arabia and USA and thereby to limit imports and demand; government

imposes higher taxes on fuel price. This not only keeps demand in

check but helps to lower import bill. Currently, Central government

levies excise duty on price charged to dealers and then after adding

dealers commission, state government levies Value added tax (VAT) and

total of all this is retail price for a common men.

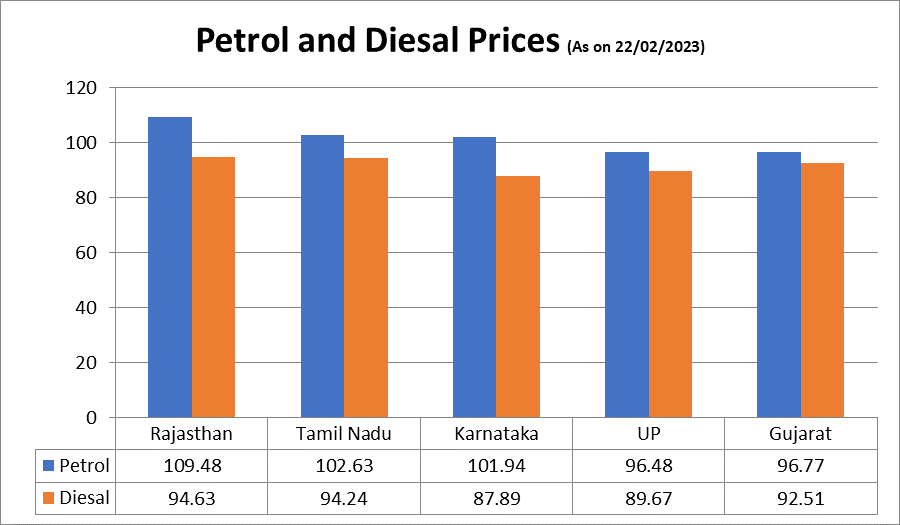

As there is disparity in taxes between centre and state government we

see different fuel prices in different states of India. Some states

like Rajasthan, Telangana, Tamil Nadu and etc imposes higher VAT and

as a result we see higher fuel prices in those states.

What factors Determines Fuel prices in India?

First and foremost determinant of fuel pricing is rate of crude oil

prices in international markets. Since crude oil price depends on its

highly volatile demand and supply, it becomes very hard to predict

crude prices. However, since past one year India started importing

crude oil from Russia at highly discounted prices as compared to past

years.

Secondly, India uses US Dollar ($) as base currency to buy crude from

OPEC and USA. Therefore, fluctuations in US $ against Indian INR would

also contribute towards its pricing. Third, Crude oil is imported by

Oil Marketing Companies (OMC's) and distributed to dealers. Thus, OMC

adds freight charges, refining cost of fuel, customs duty, import

parity price, refinery transfer price and so on. Then OMC distributes

to dealer after fixing some commission.

Fourth determinant would be taxes levied by centre and state. As

discussed above, there is in disparity in taxes between centre and

state. However, eliminating excise duty and VAT and bringing fuel

price under GST lens would clear out this discrepancy. However,

different state impose different VAT rates and because of this end

consumers are facing effects of higher inflation. In May 2022, the

central government reduced excise duty on petrol and diesel prices by

Rs.8 and Rs.6 respectively. This move was taken to cool down the

retail inflation and also complement the reduced monetary rates.

The need of Including Petrol, Diesel and Gases under the ambit of GST:

The price of petrol has risen above the ₹100-mark in major states

across the country and the government has cited the reason as rising

international crude oil prices. It should be noted that more than half

of the money paid by the consumer to purchase fuels goes towards some

tax or the other expenses like cess.

In my view, bringing domestic fuels under GST umbrella would not only

be beneficial to common men but it would also help to bring inflation

in check. There has been long demand to bring fuel under GST since its

introduction. But recently, our Finance Minister Nirmala Sitharaman

expressed central government willingness to bring petrol and diesel

under GST ambit, however centre cannot take sole decision as it comes

under purview of GST Council to determine its decision. Interestingly,

GST council comprises of Finance ministers of all states and it would

be very difficult to bring state government under same page.

To our knowledge, highest tax slab under GST is 28% and if petrol,

diesel comes under GST, maximum tax imposed can be 28% which far less

than current tax rate. Also, tax component would stand divided but

state government would lose its independent stature for deciding VAT

for fuel. Also, state government would have to be depended on centre

for getting back part of their dues. This would not only lower their

tax collection but also disturb states ongoing budgets and social

development programs.

Assuming, Petrol comes under GST, Let's see how prices would be

determined:

Source: Cleartax

Source: Cleartax

From the above table, we can conclude that price of petrol can fall around 20% if it comes under GST. This fall can contribute to building immensely towards India's economic development as retail inflation would come under RBI's desired level, logistical cost for all commodities would fall and consumer would left with higher disposable income to spend. With rising disposable income, discretionary and non- discretionary spending increases, boosting jobs and overall economic development for all major sectors of economy.

Disclaimer: This article has been written by Jay Patel - Our Senior Research Analyst and originally published on Smart Investment website.