SHOULD YOU SWEETEN YOUR PORTFOLIO WITH SUGAR STOCKS?

Jay Patel | 11 FEB 2023

Government envisions increasing ethanol blending with petrol (EBP) to 20% by 2030.

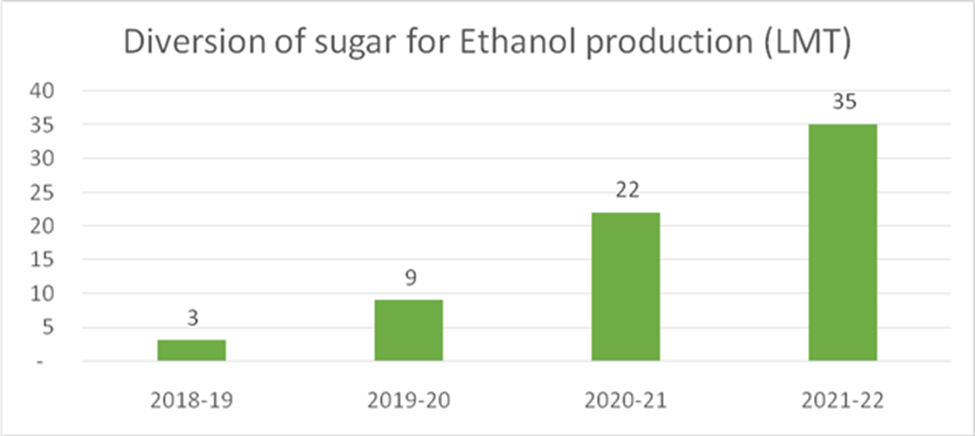

With Indian government Ethanol Blending Program (EBP) initiative sugar sector is poised for tremendous opportunities in coming years. Optimism for Indian sugar industry is currently very high as production and consumption of sugar scales to high levels in October 2021 – September 2022 season. According to PIB release, India led's world in terms of production and consumption of sugar and India emerged as 2nd largest exporter of sugar after Brazil. India exported a record 109.80 LMT of sugar this year. International price of sugar is trading near its 52 week high zone, which contributes to high profitability for sugar companies. India recorded astounding sugarcane production to over 5000 lakh metric tons (LMT) in last 2021-22 sugar season. While 35 LMT out of 5000 LMT sugar have been used towards ethanol production and 359 LMT sugar used by sugar mills. Let's look at sugar exports season wise:

Source: PIB Releasse

Source: PIB Releasse

Currently government has reduced export quota from 110 LMT last year

to 60 LMT for current sugar season i.e. October 2022- September 2023.

Reduction in export quota would ensure price stability in domestic

market as supply would be higher. This would also keep inflation in

sugar prices in check. Another positive outlook for Indian sugar

sector comes from Brazil. Brazil production season enters post April

and till then Sugar companies are poised to take benefit from high

international sugar prices. Industry experts are very optimistic about

sugar sector guidance as government is expected to increase export

quota for sugar. If government increases export quota by another 25-30

LMT, Sugar companies would be in sweet spot.

Ethanol, a by-product of sugarcane is poised to play pivotal role in

reducing India's fuel import bill. Currently, government is

prioritizing diversion of sugar for ethanol production. Government is

encouraging sugar mills to divert its excess sugarcane production for

ethanol production. Recently, Indian government announced 100%

incentive for sugarcane production given for ethanol production from

B-heavy molasses, sugarcane juice and syrup.

Source: PIB Releasse

Source: PIB Releasse

Government envisions increasing ethanol blending with petrol (EBP) to

20% by 2030. Government is currently encouraging cars makers to adhere

to e20 compliant engines by April 2023 and flex fuel engines by April

2024. This policy would lead to exponential growth in sugarcane

production and sugar diversion for ethanol production. This would not

only minimize cost of inventory storage for companies but also

improves working capital cycle thereby saving cost leading to better

profitability and high return ratios. This would also helps to reduce

import bill as India is one of the largest fuel importing country.

Ethanol blending program provides tremendous benefits to economy as a

whole as decrease in fuel cost would have rippling effects on price of

other commodities and particularly inflation.

To sweeten sugar sector, government has reduced GST on sugar from 18%

to 5%, this move would have positive impact on profit margins of sugar

companies. Considering governments continuous efforts to support sugar

industry either through EBP, sugarcane pricing policy or through

various other export oriented schemes, we believe sugar companies

would be in sweet spot as increasing operational margins, profit

margins and sugar export quota along with stability in international

sugar price would auger well for the industry.

Disclaimer: This article has been written by Jay Patel - Our Senior Research Analyst and originally published on Smart Investment website.