Equity & Derivatives Broking

Whether you want to build sustainable and futuristic assets through equity trading or the more lucrative and short-term trading in derivatives, our experts will be by your side and guide you through the nuances of Equities and Derivatives trading.

We Offer:

- Prompt Equity trading on mobile devices

- Informed trade executions

- Customized brokerage plans

- Cash/Margin trading

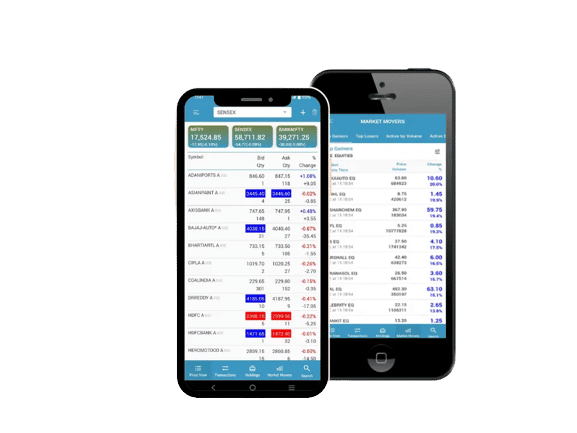

Mobile Trading

In the day and age where you have the world at your fingertips through your smartphone, we, at InvestMentor simplify your trading requirements through a user friendly mobile application loaded with features

- Technical Indicators

- Efficient & Reliable

- Options Strategies

- Multiple Watch Lists

- Key Information and Market Updates

Depository Services

InvestMentor is an active member of one of India's largest depository, NSDL and all its services are available across all our branches across Gujarat. With InvestMentor, you will be able to access a cost-effective and reliable trading experience, for both, trading and depository services.

We Offer:

- Competitive DEMAT charges along with free Account Maintenance Charges (AMC) for life

- Operating electronically to reduce paperwork and save time

- Regular account Status updates

- Instant disbursement of non-liquid benefits

Mutual Funds

Broaden your investment horizons by investing in a variety of mutual funds and save taxes with InvestMentor experts ready to guide you for a wise financing strategy. We have a carefully curated selection of profitable mutual fund investment plans that will be in alignment with your investment targets. . Through our unique customer focused approach, our clients will have greater clarity on how to achieve their dreams in a disciplined manner as per their risk appetite and investment needs.

- Start Investing with very low initial capital

- Goal based Systematic Investing

- Invest In ELSS and get Rs. 1,50,000 as tax reduction (Section 80C)

- Risk Diversification and Higher liquidity

- Lower tax on debt funds than traditional FD’s

- Opportunity to invest in US and Japan markets

Insurance

Whether you wish to secure the future of your family or ensuring good health, our team is dedicated to finding the best insurance solution that suits clients need. We offer a wide range of general insurances which include health, travel, motor, business, etc. No matter what your life goals are, our insurance experts will guide you with the right set of insurance plans as per your needs.

- Tax Benefits up to sixty-five thousands

- Hassle-free documentation

- Monthly, Quarterly and Yearly Insurance Plans

- Financial security for individuals and their loved ones

- Experienced and responsive support team

Initial Public Offering (IPO)

IPO’s provide great opportunity to invest in companies at early stages which gives the opportunity to get stocks at the lowest possible or discounted price instead of the cut-off price. Early investments often provide great returns over long and short term. Our experts will guide you in IPO application process. We also extend our service by providing prompt Demat & Trading account opening through our website.

Dematerialization

Convert your old physical shares certificates into Demat form and start trading instantly. Our team will also guide you through account opening process and help you open account promptly. We also have a team of experts who can advise you in case of delisted and merged companies shares and as well as trouble shooting.

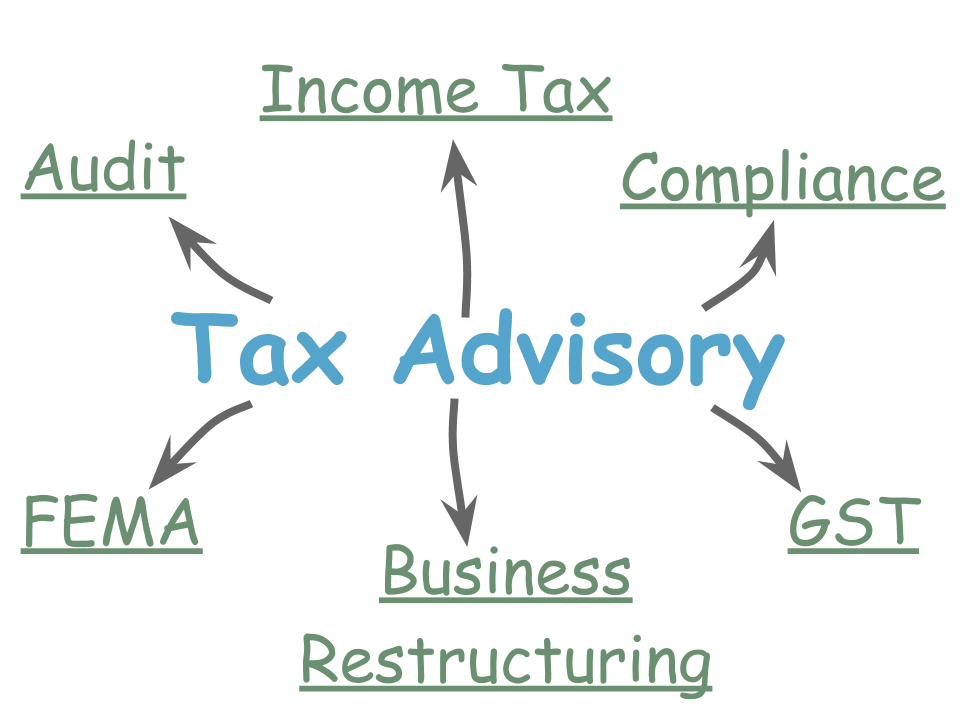

Tax Advisory

We provide tax advisory services and can help you lower your tax exposure and foresee the risks involved in complex taxation laws. Our team will guide you in understanding Indian tax structure and offer timely & accurate advice.

Our comprehensive suite of tax and regulatory services includes the following:

- Audit

- Tax advisory

- FEMA

- Business Restructuring

Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds (SGBs) is a good way to invest in gold online. You do not require physical lockers to store it. Bonds are issued by Govt. of India, so it's also the safest way to hold gold.

Why invest in Sovereign Gold Bonds?

- Earn 2.5% assured interest per annum on the investment

- Asset appreciation opportunity plus assured interest

- Minimum amount - 1 gram, Maximum amount – 4 kg for Individuals

- No TDS applicable

- Can be used as collateral for Loans

- Eligible for conversion into Demat form

- Enjoy the ease of investing through InvestMentor Securities Limited

- No Capital Gains Tax on redemption